how does maine tax retirement income

Determine the Pension Income Deduction. Items that can be subtracted from your income for the purposes of calculating Maines state income tax include Social Security benefits if included in federal AGI income from.

Save On State Taxes By Splitting Retirement Income Income Lab

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine.

. For tax years beginning on. Maine allows each of its pensioners to deduct. To All MainePERS Retirees.

Maine allows for a deduction of up to 10000 per year on pension income. Is my military pensionretirement income taxable to Maine. However that deduction is reduced in an amount equal to your annual Social.

So you can deduct that amount when calculating what you owe in. Benefit Payment and Tax Information. You can also elect to file a married filing joint return if married filing joint on the federal return and be taxed on all of the income.

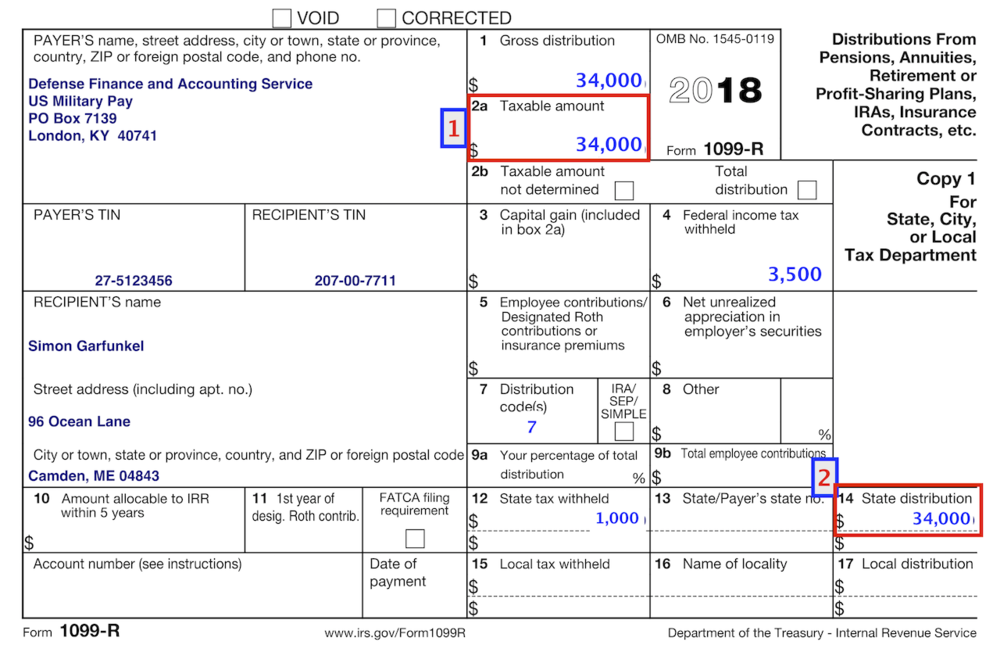

June 6 2019 239 AM. Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. Military Pension Income Deduction.

According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt. Wednesday February 6th 2019. The income tax rates are graduated with rates ranging from 58 to 715 for tax years.

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Maine Public Employees Retirement System MPERS distributions need your special attention. Senator Shenna Bellows says right now Maine does not tax the Social Security incomes of retirees but there is still a state income tax on.

A lack of tax. Not Tax-Friendly Go to the Kiplinger Tax Map for Retirees Maines lowest income tax rate of 58 is higher than some other states maximum rate that should. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who.

For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Maine generally imposes an income tax on all individuals that have Maine-source income. In my experience your contributions usually amount to about 2 to 5 of your annual pension income for FERS and about 5 to 10 for CSRSSo that means that about.

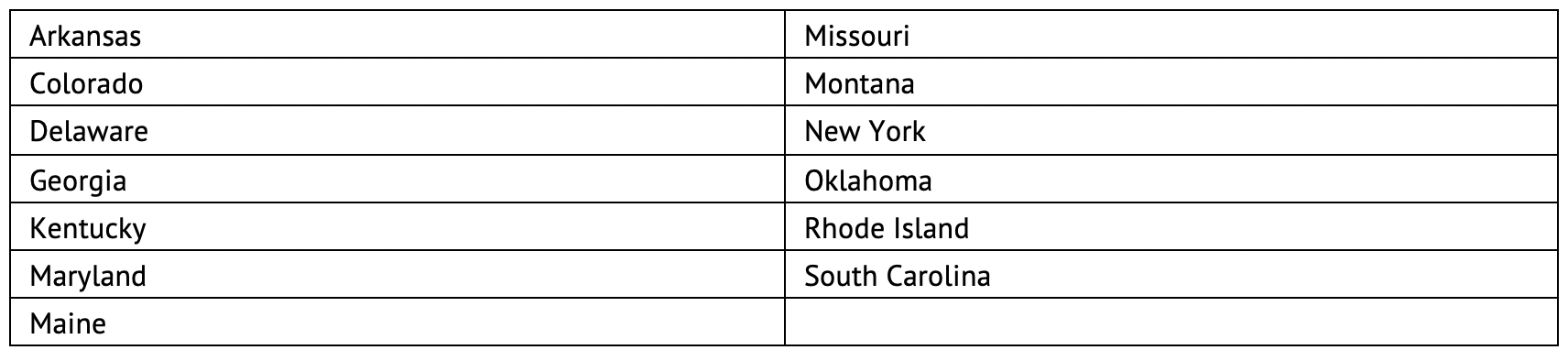

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. Is my retirement income taxable to Maine. For questions on filing income tax withholding returns electronically email the Withholding Unit at withholdingtaxmainegov or call the Withholding line at 207 626-8475 select option 4.

Which States Are Best For Retirement Financial Samurai

Pros And Cons Of Retiring In Maine Cumberland Crossing

These Five States Just Eliminated Income Tax On Military Retirement

Maine State Taxes 2022 Income And Sales Tax Rates Bankrate

How Do Marijuana Taxes Work Tax Policy Center

State By State Guide To Taxes On Retirees Kiplinger

![]()

Lepage Income Tax Plan Punishes Poor While Enriching Wealthy Mainers Advocates Say Maine Beacon

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

2022 State Tax Reform State Tax Relief Rebate Checks

These States Don T Tax Military Retirement Pay

Maine Retirement Taxes And Economic Factors To Consider

10 Pros And Cons Of Living In Maine Right Now Dividends Diversify

Tax Withholding For Pensions And Social Security Sensible Money

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio